|

|

|

The Cash-Less Policy in Nigeria: Issues, Challenges And Prospects

By Okoli Hyginus Nnaemeka

THE CASH-LESS POLICY IN NIGERIA: ISSUES, CHALLENGES AND PROSPECTS

OKOLI HYGINUS NNAEMEKACONTACT: 08034538331, Hymaco4@yahoo.com, ossai4u2@gmail.com

ABSTRACT

The Central Bank of Nigeria recently introduced the cash-less policy to reduce the volume of cash used for business transactions and thereby reduce cash handling costs by banks amongst other objectives. The success of this policy is dependent on the development and adoption of alternative payment options by bank customers, one of which is the use of POS. However, in spite of the potentials of the use of these electronic banking means, its usage is still low. Therefore, this paper is motivated by the seeming inadequacy of Nigeria in adopting and implementing the cash-less economic policy. The problem is defined by Nigeria’s backdrop level of development both technologically and educationally. The major objective of the study is to examine the economic implication of the CBN Cash-less Policy in Nigeria, and its level of compliance considering some infrastructural deficit using Rogers’ Diffusion of Innovation theory as the theoretical framework. Five research hypotheses were formulated in line with the objectives of the study. The descriptive research design was adopted for the study with a sample size of 400 through Taro Yamane formula. The research was conducted in Aba a commercial city in Abia State, this city is one the pilot implementation cities of the new Cash-less policy in Nigeria .The questionnaire which was structured was the main instrument used for data collection. The data collected was subjected to face validity test and chi – square (x2) technique was used to test the hypotheses. The results indicate that: majority of Nigerians are already aware of the policy and majority agree that the policy will help fight against corruption/money laundering and reduce the risk of carrying cash. Major problems envisaged to hamper the implementation of the policy are poor infrastructure, cyber fraud and illiteracy. Based on the findings some recommendations were made. Some of those recommendations are: the government should adopt a different strategy to educate the non-literate Nigerians about the cashless economy, provision of adequate and reliable infrastructure and a framework should be worked out to provide cyber security in Nigeria.

INTRODUCTION

The recent evolution of technology for financial transactions poses interesting questions for policy makers and financial institutions regarding the suitability of current institutional arrangements and availability of instruments to guarantee financial stability, efficiency and effectiveness of monetary policy. Odior and Banuso (2012), noted that throughout the course of history, different forms of payment systems have been in existence. Initially, trade by barter was common. However, the problems of barter such as the double coincidence of wants necessitated the introduction of various forms of paper money. Nevertheless, the need for the economy to meet up with the emerging technology laid to introduction of “Cashless Society”.

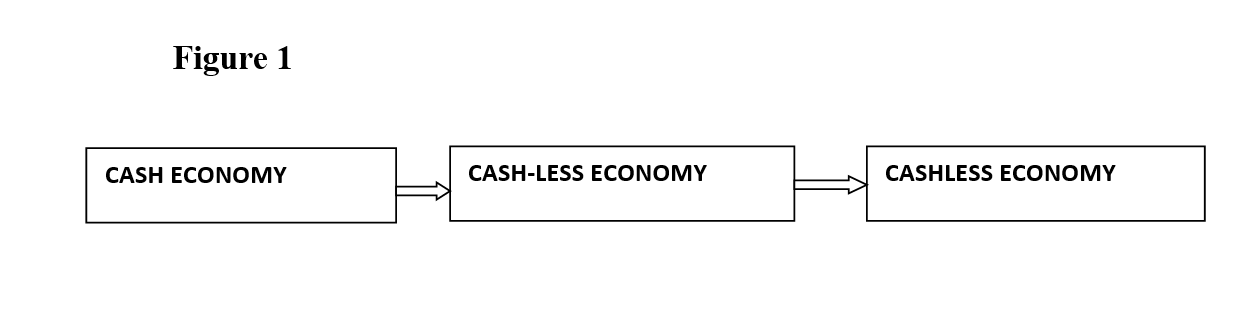

At the end of the 1980s, the use of cash for purchasing consumption goods in the US has constantly declined (Humphrey, 2004). Hence, most LDCs (Less Developed Countries) like Nigeria are on the transition from a pure cash economy to a cash-less and finally to cashless economy one for developmental purposes. Little wonder why the Central Bank of Nigeria recently introduced a Cashless policy.

The Central Bank of Nigeria (CBN) has introduced a new policy on cash-based transactions which stipulates a ‘cash handling charge’ on daily cash withdrawals or cash deposits that exceed N500,000 for Individuals and N3,000,000 for Corporate bodies. The new policy on cash-based transactions (withdrawals & deposits) in banks, aims at reducing (NOT ELIMINATING) the amount of physical cash (coins and notes) circulating in the economy, and encouraging more electronic-based transactions (payments for goods, services, transfers, etc.). (http://www.cenbank.org/cashless/.CBN 2012).

In one of the editorial interviews of the Daily Sun to the Head of Shared Service CBN, Mr. Chidi Umeano, on 13th July, 2013. Mr. Umeano stated that the Cashless policy of the CBN is not against people carrying cash at all, but if they must carry cash, they should be ready to pay for the charges. He argued that such economic policy will help to reduce financial crime, enhance the economy, reduce the volume of money in circulation, encourage E-banking, E-commerce and go a long way to provide for Nigeria the platform it needed to attain the vision 20: 2020

According to the Central Bank of Nigeria (CBN), the new Cash policy was introduced for a number of key reasons, including, To drive development and modernization of our payment system in line with Nigeria‘s vision 2020 goal of being amongst the top 20 economies by the year 2020. An efficient and modern payment system is positively correlated with economic development, and is a key enabler for economic growth. To reduce the cost of banking services (including cost of credit) and drive financial inclusion by providing more efficient transaction options and greater reach and to improve the effectiveness of monetary policy in managing inflation and driving economic growth.

In addition, the Cash policy aims to curb some of the negative consequences associated with the high usage of physical cash in the economy, including: high cost of cash: high risk of using cash, high subsidy, informal economy and inefficiency & corruption (CBN, 2011).

Dugeri (2013) rightly noted that recently in Nigeria, issues on the CBN Cash-less policy have constituted the themes and subject matters of many workshops, conferences and symposia. They have also made headlines on pages of the national dailies and periodicals and have become subjects of discussions in learned circles. The considerations range from the constitutionality of the policy to its economic advantage and disadvantage and criticisms. ‘The robust interest which the policy has generated is hardly surprising considering the enormous implications its applicability will have on the lives of ordinary Nigerians and the business environment’( Dugeri, 2013). A Cashless economy is an environment in which money is spent without being physically carried from one person to the other. The first issue in the cashless economy is the issue of electronic purse. This is electronic information that is transmitted to a device which reveals the information about how much a person has stored in the bank and how much he can spend. In an editorial comments of the Nations newspaper 2013,

The moderated cash-less policy of the Central Bank of Nigeria(CBN) begins today in the Federal Capital Territory(Abuja), Abia, Anambra, kano, Ogun and Rivers states. Ahead of today’s take-off of the policy, several commercial banks have through emails, text messages and formal letters, been sensitizing their customers on the need to embrace the alternative payment options. (The Nation Newspaper, 1st July, 2013:6).

Dugeri (2013) rightly noted that the policy framework stipulates that cash-in- transit lodgment and cash evacuation service will no longer be available for individuals and merchants. For individual account holders, charges on cash transactions will apply when daily withdrawals and deposit are in excess of N500,000, while for corporate accountholders, charges will apply when daily withdrawal and deposit are in excess of N3,000,000. (CBN, 2013).

The CBN expects that the success of the pilot scheme in Lagos would help in implementing it in all parts of the country effective from January 1 2013, but this has somehow becomes a mirage due to some teething problems faced in its implementation in Lagos. This is more so with the believe of our people, who sell in million of naira daily but fail to bank the money as expected, even if they have bank account they may find it difficult to use the POS terminals, due to their limited literacy level( Dugeri 2013). The CBN explained that the policy would empower the previously unbanked populace to open accounts and perform e-transactions across the nation without having to visit their bank branches, but experience has shown that people are yet to embrace the policy.

.

Aside from the good contents of the policy stated above, the new policy has received lots of criticisms. There are several complaints from different quarters that sufficient facilities have not been provided to make the system smooth. The E-payment and withdrawal system is said by many who have tried to use it to be filled with hitches. Sometimes, one is charged for service not successfully rendered. There are, therefore, fears of possible loss of money through fraud. It has also been argued that the policy is embedded with impediment, loopholes and challenges in its implementation and some are waiting to see the economic impacts. (Odior and Banuso 2012). Dugeri (2013), also affirms the inevitability of Cashless policy challenges. Indeed, the first implementation phase of this policy received lots of criticisms and was subjected to review and modifications.

Adoption of electronic banking which was supposed to ease banking transactions rather resulted to woes to customers. Most customers complain of time wasted in banks, mostly when there is network failure due to linkage problem between the central server and the branches. This aside, banks have since 2000 being introducing payment cards in form of ATM cards, but usage has been very low due to lack of interconnectivity and poor infrastructure. (Odior and Banuso, 2012).

LITERATURE REVIEW

A great deal of work has been done on the Cash-less policy of the CBN in Nigeria mainly inform of criticism of the policies implementation. It is important to note that cash-less policy is part of CBN monetary policy framework. The monetary policy as argued by Anyanwu (1977:272) is aimed at moderating the inflation rate, promotion of economic growth, reduce pressure on external sector, stabilization of the naira exchange rate and inducing increased financial saving, investment and employment through the use of monetary policy instruments effectively, that is checking the quantity of money in circulation at any particular time. Cash-less policy is one of the new instruments of the monetary policy of the apex bank of Nigeria that is aimed at encouraging the use of electronic means of transaction in the economy and reduces the use of physical cash. Therefore in discussing these abundant literatures in the Cash-less policy the following sub- themes will be used.

THE CONCEPT OF CASH-LESS ECONOMY

According to Dugeri (2013), a cashless society is a culture where no one uses cash, all purchases being made are by credit cards, charge cards, cheques, or direct transfers from one account to another through mobile banking. The cashless society envisioned here refers to the widespread application of computer technology in the financial system. He noted that electronic cash is a system which allows individuals to purchase goods or services in today’s society without the exchange of anything tangible. The term money still exists, but it is more in an electronic form than previously. Electronic cash is a term becoming more acceptable as the world makes a shift towards a cashless society.

Okoye and Ezejioffor (2013),hold the view that, Contrary to what is suggestive of the term, cashless economy does not refer to an outright absence of cash transactions in the economic setting but one which the amount of cash-based transactions are kept to the barest minimum. According to them, It is an economic system in which transactions are not done predominantly in exchange for actual cash. It is not also an economic system where goods and services are exchanged for goods and services (the barter system). Cashless economy does not mean a total elimination of cash as money will continue to be a means of exchange for goods and services in the foreseeable future. It is a financial environment that minimizes the use of physical cash by providing alternative channels for making payments (Azeez, 2011). The cashless economy policy of the CBN is designed to provide mobile payment services, breakdown the traditional barriers hindering financial inclusion of millions of Nigerians and bring low cost, secure and convenient financial services to urban, semi-urban and rural areas across the country.

Dugeri (2013) rightly noted that the Cash-less policy framework in Nigeria stipulates that cash-in- transit lodgment and cash evacuation service will no longer be available for individuals and merchants. For individual account holders, 10% charges on cash transactions will apply when daily withdrawals and deposit are in excess of N500,000, while for corporate accountholders, 10% charges will apply when daily withdrawal and deposit are in excess of N3,000,000. (CBN, 2013). The CBN explained that the policy would empower the previously unbanked populace to open accounts and perform e-transactions across the nation without having to visit their bank branches, but experience has shown that people are yet to embrace the policy.

THE NEED FOR CASH-LESS POLICY IN NIGERIA ECONOMY

EFInA(2013:1) observed that increasing numbers of countries have adopted policies to accelerate the use of electronic channels and reduce the use of cash. The motivations for these policies vary: many are primarily concerned with reducing tax evasion, some with fighting crime, and a few are now explicitly linked to financial inclusion though the latter link is not necessarily immediately nor automatically achieved.

Adewuyi (2011) is of the view that the adoption of Information and Communication Technology in banking sector is generally referred to as electronic banking (e -banking) and application of its concepts, techniques, policies, and implementation strategies to banking services has become a subject of fundamental importance and concerns to all banks and indeed a pre-requisite for local and global competitiveness because, it directly affects the management decisions, plan and products and services to be offered by banks. It has continued to change the way banks and the corporate relationships are organized worldwide and the variety of innovation of service delivery.

Woherem (2000) claims that only banks that overhaul the whole of their Payment and delivery systems and apply Information and Telecommunication Technology to their operations are likely to survive and prosper in the new millennium.

In Nigeria, the Central Bank of Nigeria (CBN) announced its Cash-less policy in 2011 and commenced a pilot implementation of the policy in Lagos State in April 2012. To consolidate on this statement, Olanipekun, Brimah, & Akanni(2013:2), observed that the apex financial institution in any economy is the Central Bank of that country and it plays a major role in the economic development process of that nation. De’kock (1998:4) defines a central bank as a bank which constitutes the apex of the of the monetary and banking structure of a country and which performs as best as it can in the national economic interest the following functions of regulations of currency in accordance with the requirements of business and the general public, custodian of cash reserves of commercial banks, custodian and management of foreign exchange observes, lender of last resort, controller of credit clearing house for transfer and settlement and also acts as the banker, fiscal agent and adviser to the government.

In Nigeria, the mission statement of the Central Bank of Nigeria (CBN) is to be proactive in providing a stable framework for economic development through the effective, efficient and transparent implementation of monetary and exchange rate policy and management of the financial system (CBN,2011). It is in line with this mandate that it has introduced various monetary policies that would strengthen the financial system and cashless policy which ensures efficient and modern payment system is one of such which is geared to achieve the goal of being amongst the top 20 economies by year 2020 (Vision 20:2020). This is in fact one of the cardinal objective of cashless policy.

According to Odior and Banuso (2012:291), to examining the implications of Cash-less system, it is necessary to review how conventional money has evolved over time. Money performs a number of roles in economic activity; it is a unit of account, store of value, medium of exchange and means of deferred payment. Also, money has evolved over the centuries to minimize the friction of transaction costs that are involved in mediating exchange. In fact, the process can be observed from the development of the very first monetary products. For instance, conducting economic transactions in barter economies involved high transaction costs as considerable time and effort was required in finding suitable partner.

Subsequently, another facet in the evolution of money was the need for fungiblity and divisibility. Hence, the advent of study money (notes and coins) made the process less costly by allowing people specialize in production based on their strengths and by enabling the monetary authorities to mint coins in convenient denominations, thereby creating divisibility (Baddeley, 2004 in Odior and Bnuso, 2012:292).

EFInA (2013:5) noted that, Nigeria is one of a number of countries on the journey towards what the BTCA White Paper describes as an “inclusive cash lite society”: one in which the majority of all payment transactions become electronic but in which cash continues to co-exist, though increasingly at the margins of economic life. Only a few developed countries such as Sweden, the Netherlands, Canada and the United States have passed the threshold to being “inclusive cash lite” and only in recent years; Canada, for instance, reached the 50% tipping point in 2010.

CBN 2011, noted that Nigeria is cash based economy prior to the introduction of the cash-less policy. The apex bank made it clear through an illustrative table below.

Table 1: Cash Related Transactions

Channels of Payment |

Transaction Volume |

Percentage of Transaction |

ATM Withdrawals |

109,592,646 |

50.96% |

Cash withdrawals (Over-The-Counter) |

72,499,812 |

33.7% |

POS (Point of Sale) Terminals |

29,159,960 |

13.56% |

Cheques |

1,059,960 |

0.49% |

WEB |

2,703,516 |

1.26% |

Total |

215015894 |

100% |

(Source: CBN Website, 2011. http://www.cenbank.org/)

A cursory look at Table 1 indicates that, withdrawals through ATM channels accounts for the largest percentage, followed by OTC cash withdrawals. This implies that cashless banking instruments, particularly ATMs, are attracting high level of patronage and acceptability among Nigerians (CBN Website, 2011).

Table 2: Use of E-Money Products

MARKET SHARE IN THE E-PAYMENT MARKET IN 2008-2011

E-PAYMENT VOLUME (MILLION) VALUE(N ‘ BILLION)

SEGMENT |

2008 |

2009 |

2010 |

2011 |

|

2008 |

2009 |

2010 |

2011 |

ATM |

60.1 |

109.6 |

186.2 |

347.6 |

|

399.7 |

548.6 |

954.0 |

1561.8 |

%of Total |

91.1 |

95.7 |

95.1 |

97.9 |

99.5 |

85.0 |

88.9 |

93.4 |

|

Web(internet) |

1.6 |

2.7 |

7.2 |

3.6 |

25.1 |

84.2 |

99.5 |

58.0 |

|

%of Total |

2.4 |

2.3 |

3.7 |

1.0 |

5.7 |

13.1 |

9.3 |

3.5 |

|

POS |

1.2 |

0.9 |

1.1 |

2.1 |

16.1 |

11.0 |

12.7 |

31.0 |

|

%of Total |

1.8 |

0.8 |

0.6 |

0.6 |

3.7 |

1.7 |

1.2 |

1.9 |

|

Mobile |

3.2 |

1.8 |

1.2 |

1.9 |

0.7 |

1.3 |

6.7 |

20.5 |

|

%of Total |

4.8 |

1.6 |

0.6 |

0.5 |

0.1 |

0.2 |

0.6 |

1.2 |

|

TOTAL |

66.1 |

115.0 |

195.7 |

355.2 |

441.6 |

645.1 |

1072.9 |

1671.4 |

SOURCE: (CBN 2011 ANNUAL REPORT AS CITED IN Olanipekun, Brimah, & Akanni 2013:3)

Olanipekun, Brimah, & Akanni(2013) in their analysis also noted that Nigeria is cash based economy with retail and commercial payments primarily made in cash. The table above shows that the volume and value of electronic card (e-card) transactions increased significantly from 195,525,568 and N1,072.9 billion in 2010 to 355,252,401 and N1,671.4 billion, reflecting an increase of 81.5 and 55.8 per cent, respectively. The increase was attributed to enhanced public confidence in electronic card payments. Data on various e-payment channels for the period under review indicated that ATMs remained the most patronized, accounting for 97.8 percent, followed by web payments, 1.0 per cent, Point-of-Sale (POS) terminals, and mobile payments, 0.6 per cent each. Similarly, in value terms, ATMs accounted for 93.4 per cent, web 3.5 per cent, POS 1.9 per cent and mobile payments, 1.2 per cent. The number of ATMs stood at 9,640, while the volume and value of transactions amounted to 347,569,999 and N1,561.75 billion, at end-December 2011, respectively. These figures reflected increases of 86.7 and 63.7 per cent respectively over the volume and value of 186,153,142 and N954.04 billion, at end-December. (Olanipekun, Brimah, & Akanni, 2013).

ECONOMIC IMPORTANCE OF CASH-LESS POLICY IN NIGERIA

It is against this backdrop that Dugeri (2013) affirms that the apex bank in Nigeria introduced the Cashless policy. According to him, the Cashless Nigerian society, when fully implemented, has many benefits. Some of these benefits include:

- Reduction in money laundering

- Check on terrorist financing

- Effectiveness of the monetary policy

- Creation of more employment opportunities in the financial sector

- Provision of evidence against bribe givers and takers, especially the civil servants and politicians.

- Growth in the real sector of the economy. This is because credit will be available for investors. (Dugeri 2013:12).

Odior and Banuso (2012) argued that the concept of “Cashless” banking should not be mention in Nigeria lather a more preferable or achievable term like “Cash- less” with two reasons. First, Nigeria is still on the transition to a cashless economy wherein, no more study notes and coins are printed by the central bank. Secondly, Cash-less banking is already in operation in Nigeria. In their transitional model, they posit that:,

Cash-less banking may be defined as that banking system which aims at reducing, not eliminating the amount of physical cash (study notes and coins) circulating in the economy, whilst encouraging more electronic based transactions (payment for goods, services, transfers etc.). In other words, it is a combination of two e-banking and cash-based systems.(Odior and banuso 2012:304).

This statement is also in agreement with the statement of the Director consumer and Financial protection department Central Bank of Nigeria, Mr Faruk U. Shehu. He avert thus:

That most people think of cash-less society as something that is way off in the distant future and simply unrealistic but, that is simply not the case. The truth is that cash-less society is just much closer as most people image but already here with us. Our financial system is dramatically changing, and predominance of cash would gradually become a thing of the past with a lot of Nigerians embracing the cash-less policy voluntarily. (CBN quarterly publication magazine April-June 2012 volume 36,no2)

In most developing countries, cash-less economy represents a middle phase in the development of payment system as illustrated below;

From the illustration above, Odior and Banuso (2012) argued that Nigeria just left the real cash economy to cash-less economy where there is still conglomeration of cash handling and electronic means in the economy and with time move to cashless economy where every transaction or most of the transactions in the economy will be done without physical cash. This is a proof of the new policy of CBN, which state that ‘the new policy on cash-based transactions (withdrawals & deposits) in banks, aims at reducing (NOT ELIMINATING) the amount of physical cash (coins and notes) circulating in the economy, and encouraging more electronic-based transactions (payments for goods, services, transfers, etc.) (CBN, 2011).

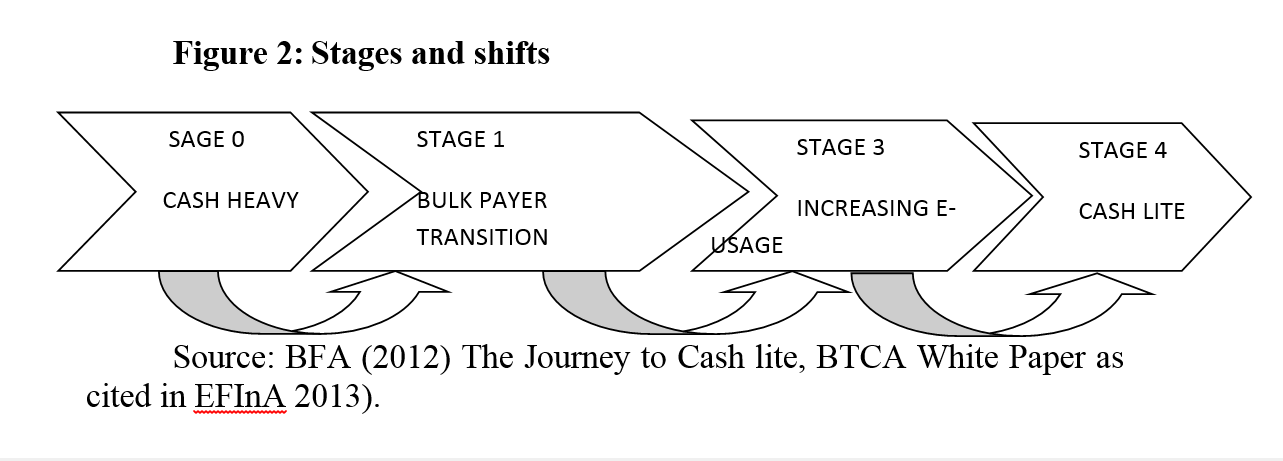

EFInA(2013), succinctly admitted that Nigeria is a transitional move to Cashless economy by identifying four stages involved in what it tagged Cash lite society.

Figure 2: Stages and shifts

Source: BFA (2012) The Journey to Cash lite, BTCA White Paper as cited in EFInA 2013).

From the foregoing analysis, Odior and Banuso 2012 and EFInA 2013 agreed that the Nigerian cash economy is on a transitional stage and at a point in a continuum. Even though that Odior and Banuso affirmed that the Nigerian economy just moved from the cash based economy stage to cash-less economy stage, EFInA in it explanation categorically stated that Nigeria economy is on the third stage of the continuum ‘increasing E-usage’.

THE CHALLENGES OF CASH-LESS POLICY IN NIGERIA

Consequently, the implementation of this Cashless policy in Nigeria featured lots of challenges. In fact Dugeri (2013) posits thus:

There are several complaints from different quarters that sufficient facilities have not been provided to make the system smooth. The e-payment system is said by many who have tried to use it to be filled with hitches. Sometimes, one is charged for service not successfully rendered. There are, therefore, fears of possible loss of money through fraud, meanwhile, information security experts have confirmed that the infrastructure supporting the cash-less system in Nigeria may be 60% vulnerable to fraud.

Siyanbola (2013), also noted the following challenges of Cash-less policy; infrastructure deficit, erratic power supply, prevalence of e-fraud, illiteracy, and inadequate data among others.

The Central Bank of Nigeria haven been informed of these challenges responded through modification of the Policy through a letter dated March 16, 2012 and addressed to operatives in the Nigeria e-Payment System and the public the CBN reviewed the provisions of the Cashless Lagos Policy to reflect feedback received from stakeholders so far. Odior and Banuso (2012), tabularized this policy adjustment through identification of the old and the newly adjusted one as thus.

Table 3: Key Contents of the Cashless Policy.

Policy Elements |

Initial Policy (April 20, 2011) |

Revised Policy (March 16, 2012) |

|||||||||||||||

Daily cumulative cash withdrawals/lodgements limits (without fees) |

*N150,000 by individuals *N1million by corporate customers |

*N500,000 by individuals *N3million by corporate customers |

|||||||||||||||

Processing fee for withdrawals above limits |

*10% by individual customers *20% for corporate customers |

*3% by individual customers *5% for corporate customers |

|||||||||||||||

Processing fee for lodgements above limits Exemptions |

*10% by individual customers *20% for corporate customers |

*2% by individual customers *3% for corporate customers

|

|||||||||||||||

Kick off dates |

*June 1, 2012 for execution |

|

|||||||||||||||

Source:( Odior and Banuso 2012:305)

2.1.5 GAP IN LITERATURE

Despite of all the reviews and discussions by many authors on the subject matter, it is still clear to know that, there still exist among them issues of misconception, misunderstanding and misinterpretation of the policy.

From the foregoing review, it is noted that some authors used the term “cashless” instead of “cash-less”, to some, they used the term cash-less to explain the term cashless and as a result of this, there exist fear among users of this policy instrument on whether the policy will benefit them as started or not. Therefore to clear these conceptual vagueness, ideological conflict, strategic confusion and ideational muddle (Okoli, 2004) of the concept by many authors, the following definition will be used in tabular form.

Cash based economy |

Cash-less economy |

Cashless economy |

This is an economic system where all the business transactions in a particular country are performed with physical cash. It precludes the use of electronic transaction. Even though, little element of electronic means of transaction exist in this type of economy but such are usually insignificant and irrelevant in the economy. |

Cash-less economy may be defined as that banking system which aims at reducing, not eliminating the amount of physical cash (study notes and coins) circulating in the economy, whilst encouraging more electronic based transactions (payment for goods, services, transfers etc.). In other words, it is a combination of two e-banking and cash-based systems. It does not out rightly preclude the use of physical cash in transaction |

A cashless economy is an environment in which money is spent without being physically carried from one person to the other in an economy. This is an extreme implementation of cash-less policy, which does preclude the use of physical cash in economy. |

Therefore, the research believed that among all odds the cash policy introduced by the apex in the country in the year 2011 is tagged “CASH-LESS” policy. Indeed this cash-less policy is a migration from the cash based economy to electronic payment channels. It principally includes e-payment, use of cheques, point of sale,(POS) automated teller machines, (ATM) mobile money, among others.

HYPOTHESES

“The purpose of the suggestion of hypotheses to any science, social or natural science is precisely to assist us in explanation or solution of particular problems to aid in perceiving the connection between phenomenon and the behavior which they exhibit” Davies and Lewis (1971:29).

Following our foregrounding discussion in the introduction of the study, the research will empirically state the following hypotheses using a comparative ideology between dependent and independent variables.

- Hi. There exists a significant relationship economic growth and adoption of cash-less policy.

- Hi. There exists a significant relationship between relative advantage and adoption of cash-less policy in Nigeria economy.

- Hi. There exists a significant relationship between high compliance and adoption of cash-less policy in Nigeria.

- Hi. There is a significant relation between poor infrastructure, policy education and ineffective implementation of cash-less policy.

- Hi. There exists a significant relationship between effective policy education, adequate infrastructure and effective implementation of cash-less policy.

OPERATIONALIZATION OF KEY CONCEPTS

In this work, there are certain concepts which are central to the work and analysis of the issues raised. It is therefore been thought necessary that these concepts be clarified particularly with regard to their usage in the discussion and consequently how they are to be understood in the study. The concepts include the following; cash based economy, cashless economy, cash-less economy, policy, ATM, POS, mobile banking, E-banking, diffusion, innovation, trialability and observability.

CASH BASED ECONOMY: This is an economic system where all the business transactions in a particular country are performs with physical cash.

CASHLESS ECONOMY: A cashless economy is an environment in which money is spent without being physically carried from one person to the other in an economy.

CASH-LESS ECONOMY: Cash-less economy may be defined as that banking system which aims at reducing, not eliminating the amount of physical cash (study notes and coins) circulating in the economy, whilst encouraging more electronic based transactions (payment for goods, services, transfers etc.). In other words, it is a combination of two e-banking and cash-based systems.

POLICY: According to Anderson (1997) policy is a relative stable, purposive course of action followed by an actor or set of actors in dealing with a problem or matter of concern.

ATMs: Meaning Automated Teller machines, a cash dispenser. it has a unique of 24/7 service facility, that is, the machine unattended to i.e. "stand alone" or "wall mounted" (outside or inside the banking hall) allows you to transact limited business without referring to any bank staff except in case of problem and difficulty round the clock. An ATM allows a customer to withdraw cash from his or bank account by entering a Personal Identification Number (PIN) after the insertion of a car into the machine and having the amount of the withdrawal immediately debit to the account of the customer.

POS: Meaning Point Of Sales terminals. These terminals are deployed to merchant locations where users swipe their electronic cards through them in order to make payment for purchases or services instead of using raw cash. As the POS terminals are online real-time, the customers bank account is debited immediately for value of purchases made or services enjoyed.

MOBILE BANKING: This service allows bank's customers to access banking service via dedicated telephone lines from the comfort of homes, offices etc. As at present, account balance could be checked, authorized inter-branch money transfer, transaction alert (withdrawal or savings) and enquiry can be made through telephone.

E-BANKING: This refers to electronic banking system with the use of electronic purse which can be effected via the internet on PCs, laptops and other devices. Bank customers who have subscribed to internet banking can do basic banking transactions via the web.

DIFFUSION: Diffusion is the process by which an innovation is communicated through certain channels over time among the members of a social system (Rogers, 2003).

INNOVATION: An innovation is an idea, practice, or object perceived as new by an individual or other unit of adoption

TRIABILITY: This is the degree to which an innovation may be experimented with on a limited basis. Generally, new ideas that may be tried on installment basis will be adopted more quickly than innovations that are not divisible

OBSERVABILITY: This describes the degree to which the outcomes of an innovation are visible to others. The easier it is for individuals to see the result of an innovation, the more likely they are to adopt such idea.

METHODOLOGY

The methodology refers to the framework of activity or operations of the research. Here it denotes holistically the range of approaches used in this research endeavour to gather the appropriate data to be used for the purpose of inference and interpretation on which to anchor explanations and predictions.

THEORETICAL FRAMEWORK

The theoretical framework that will be suitable in this study among many other theories is the diffusion of innovation theory (DOI) as propounded by E.M. Rogers in 1962. Diffusion of Innovations seeks to explain how innovations are taken up in a population. An innovation is an idea, behaviour, or object that is perceived as new by its audience. It originated in communication to explain how, over time, an idea or product gains momentum and diffuses (or spreads) through a specific population or social system. The end result of this diffusion is that people, as part of a social system, adopt a new idea, behavior, or product.

For Rogers (2003), adoption is a decision of “full use of an innovation as the best course of action available” and rejection is a decision “not to adopt an innovation” (p. 177). It also means that a person does something differently than what they had previously (i.e., purchase or use a new product, acquire and perform a new behavior, etc.). The key to adoption is that the person must perceive the idea, behavior, or product as new or innovative. It is through this that diffusion is possible.

According to Robinson (2009), diffusion of Innovations offers three valuable insights into the process of social change which are

- What qualities make an innovation spread?

- The importance of peer-peer conversations and peer networks.

- Understanding the needs of different user segments.

He further assert that these insights have been tested in more than 6000 research studies and field tests, so they are amongst the most reliable in the social sciences.

Rogers (2003), defines diffusion as “the process in which an innovation is communicated thorough certain channels over time among the members of a social system” (p. 5). As expressed in this definition, innovation, communication channels, time, and social system are the four key components of the diffusion of innovations.

INNOVATION: Rogers offered the following description of an innovation: “An innovation is an idea, practice, or project that is perceived as new by an individual or other unit of adoption” (Rogers, 2003, p. 12). An innovation may have been invented a long time ago, but if individuals perceive it as new, then it may still be an innovation for them. Also it is important to know that what seen to be new in a particular environment may have been existing in other areas depending on how the technology flows. Therefore the newness characteristic of an adoption is more related to the three steps (knowledge, persuasion, and decision). Moreover, uncertainty is an important obstacle to the adoption of innovations. An innovation’s consequences may create uncertainty: “Consequences are the changes that occur in an individual or a social system as a result of the adoption or rejection of an innovation” (Rogers, 2003, p. 436). To reduce the uncertainty of adopting the innovation, individuals should be informed about its advantages and disadvantages to make them aware of all its consequences.

COMMUNICATION CHANNELS: For Rogers (2003), communication is “a process in which participants create and share information with one another in order to reach a mutual understanding” (p. 5). This communication occurs through channels between sources. Rogers states that “a source is an individual or an institution that originates a message. A channel is the means by which a message gets from the source to the receiver” (p. 204). Rogers states that diffusion is a specific kind of communication and includes these communication elements: an innovation, two individuals or other units of adoption, and a communication channel. Mass media and interpersonal communication are two communication channels. While mass media channels include a mass medium such as TV, radio, or newspaper, interpersonal channels consist of a two-way communication between two or more individuals. On the other hand, “diffusion is a very social process that involves interpersonal communication relationships” (Rogers, 2003, p. 19). Thus, interpersonal channels are more powerful to create or change strong attitudes held by an individual. In interpersonal channels, the communication may have a characteristic of homophily, that is, “the degree to which two or more individuals who interact are similar in certain attributes, such as beliefs, education, socioeconomic status, and the like,” but the diffusion of innovations requires at least some degree of heterophily, which is “the degree to which two or more individuals who interact are different in certain attributes.” Rogers (2003) also noted that because of these communication channels’ characteristics, mass media channels and cosmopolite channels are more significant at the knowledge stage and localite channels and interpersonal channels are more important at the persuasion stage of the innovation-decision process.

TIME: According to Rogers (2003), the time aspect is ignored in most behavioral research. He argues that including the time dimension in diffusion research illustrates one of its strengths. The innovation-diffusion process, adopter categorization, and rate of adoptions all include a time dimension. These aspects of Rogers’ theory will be discussed later in more detail.

SOCIAL SYSTEM: The social system is the last element in the diffusion process. Rogers (2003) defined the social system as “a set of interrelated units engaged in joint problem solving to accomplish a common goal” (p. 23). Since diffusion of innovations takes place in the social system, it is influenced by the social structure of the social system. For Rogers (2003), structure is “the patterned arrangements of the units in a system” (p. 24). He further claimed that the nature of the social system affects individuals’ innovativeness, which is the main criterion for categorizing adopters.

According to Rogers (2003), Adoption of a new idea, behavior, or product (i.e., "innovation") does not happen simultaneously in a social system; rather it is a process whereby some people are more apt to adopt the innovation than others. Researchers have found that people who adopt an innovation early have different characteristics than people who adopt an innovation later. When promoting an innovation to a target population, it is important to understand the characteristics of the target population that will help or hinder adoption of the innovation. Therefore, there are five established adopter categories, and while the majority of the general population tends to fall in the middle categories, it is still necessary to understand the characteristics of the target population. When promoting an innovation, there are different strategies used to appeal to the different adopter categories.

- Innovators - These are people who want to be the first to try the innovation. They are venturesome and interested in new ideas. These people are very willing to take risks, and are often the first to develop new ideas. Very little, if anything, needs to be done to appeal to this population.

- Early Adopters - These are people who represent opinion leaders. They enjoy leadership roles, and embrace change opportunities. They are already aware of the need to change and so are very comfortable adopting new ideas. Strategies to appeal to this population include how-to manuals and information sheets on implementation. They do not need information to convince them to change. Once the benefits start to become apparent early adopter leaps in.

- Early Majority - These people are rarely leaders, but they do adopt new ideas before the average person. That said, they typically need to see evidence that the innovation works before they are willing to adopt it. Strategies to appeal to this population include success stories and evidence of the innovation's effectiveness.

- Late Majority - These people are skeptical of change, and will only adopt an innovation after it has been tried by the majority. Strategies to appeal to this population include information on how many other people have tried the innovation and have adopted it successfully.

- Laggards - These people are bound by tradition and very conservative. They are very skeptical of change and are the hardest group to bring on board. Strategies to appeal to this population include statistics, fear appeals, and pressure from people in the other adopter groups.

Source Everett M. Rogers, Diffusion of Innovations, Fifth Edition 2003, Free Press, New York.

Rogers (2003), observed that the stages by which a person adopts an innovation, and whereby diffusion is accomplished, include awareness of the need for an innovation, decision to adopt (or reject) the innovation, initial use of the innovation to test it, and continued use of the innovation.

FIVE MAIN FACTORS THAT INFLUENCE ADOPTION OF AN INNOVATION

There are five main factors that influence adoption of an innovation, and each of these factors play an important role to a different extent in the five adopter categories. To some other diffusion scholars there are tagged the five qualities that determine the success of an innovation. Odumeru (2013) identified them as follows.

- RELATIVE ADVANTAGE - The degree to which an innovation is seen as better than the idea, program, or product it replaces.

- COMPATIBILITY - How consistent the innovation is with the values, experiences, and needs of the potential adopters.

- COMPLEXITY - How difficult the innovation is to understand and/or use.

- TRIABILITY - The extent to which the innovation can be tested or experimented with before a commitment to adopt is made.

- OBSERVABILITY - The extent to which the innovation provides tangible results.

APPLICATION OF THE THEORY TO THE STUDY

In this study the new Cash-less policy of the Central Bank of Nigeria is perceived as new technology and an innovation to the existing cash handling policies in Nigerian economy. As an innovation, the researcher tries to find out the willingness of the population to adopt to this improved system.

The introduction of Cash-less policy by CBN which emphasizes the use of POS, ATMs E- banking and other mediums of transactions that does not encourage physical cash is an idea, practice or project perceived as new by individuals in Nigeria, which according to Rogers (2003), is an innovation.

Therefore, for this new Cash-less policy to properly diffuse within the social system, proper communication channels, time and social acceptance need to be developed in order to share the advantages of this new technology. Rogers (2003), posits that communication is a process in which participants create and share information with one another in order to reach a mutual understanding. Other factors according to Rogers that needed to be harnessed for effective diffusion of the new Cash-less policy as have been mentioned early by the researcher are time and social system. The time for adoption and the social system respectively affects individuals’ innovativeness.

Finally, the five constructs that determine the adoption of new technology (Cash-less policy) in the society according to Rogers (2003) are relative advantage, compatibility, complexity, triability and observability and it is upon some of these constructs and the factors that determines effective implementation of the Cash-less policy that the researcher developed his hypotheses and analysis.

GENERAL INFORMATION ABOUT THE SUBJECT OF THE STUDY/ STUDY AREA

Here the research is presenting the activities of the Central Bank of Nigeria (CBN) on cash-less policy which is aimed at economic growth and development in Nigeria.

This new technology in use of cash in the economy arose as a result of many economic reasons. Humphery (2004), observed that at the end of 1980s, the use of cash for purchasing consumption goods in the US has constantly declined. Hence, most LDCs (less developed countries) like Nigeria are on the transition from a pure cash economy to “cash-less” one for development purposes.

According to Umeano David, the head of the shared services (CBN), who stated that the Nigerian bankers committee commissioned a study to identify cost drivers and possibility of proffering lasting solutions? The result of the study indicated, amongst others, high cash intensity in the economy and its impact on high cost structure in the financial value chain. (CBN April publication 2012,vol36, no2). Also the study noted that, on average, 30% of Branch physical space and employes is devoted to cash logistics, handling and storage, therefore the total cash management costs (excluding cost of production, distribution, processing and destruction by CBN) was projected to exceed N192billion by 2012. (see CBN april publication 2012, vol 36, n2).

The study by the Nigerian bankers committee, further showed that only 10% of customers were responsible for cash transaction above N150,000 in bank daily. This implies that the cost of cash for the 10% customers that make high volume cash transactions was subsidized by the mass public (90%) of banking customers. (See CBN publication 2012).

It was in view of these findings that the Central Bank of Nigeria on April 2011 introduced cash- based transaction which stipulates a “cash service charge” on daily cash withdrawals or cash deposits that exceed N500,000 for private individuals and N3000,000 for corporate bodies. The new policy on cash- based transactions (withdrawal and deposits) in banks, aims at reducing and not eliminating the amount of physical cash circulating in the economy, and encouraging more electronic based transactions (payments for goods, services, transfers, etc). (Kehinde Ibrahim “x-raying cashless policy” in Business and Economy magazine 25th march 2013 p 38-40).

This moderated cash-less policy of the Central bank of Nigeria first phase implementation started in Lagos state on December 2012 tagged “cash-less Lagos”, while other pilot state as stated by CBN commenced implementation of this policy on January 1st 2013. These pilot states include the federal capital territory (Abuja), Abia state, Anambra state, Kano state, Ogun state and Rivers state.

It is upon one o these pilot states that the researcher chooses his study area. The researcher chose Aba a commercial city in Abia state as his study area. The choice of the researcher was characterized by many reason that will enable obtain a reliable information. First, Aba a commercial city in Abia state is one of the phase two areas that were mapped out by the central bank of Nigeria for implementation of cashless policy. (see business and economy magazine march 25th 2013 p38 ). Secondly, because of the large volume of cash transaction in Aba as noted by CBN publication 2012. According to Wikipedia (2014), Aba is a city and a big trading center, upon the creation of Abia state in 1991, Aba was divided into two local government areas namely; Aba south and Aba North. Aba south is the main city center and the heart beat of Abia State, south-east Nigeria. Economically, Aba is surrounded by oil wells which separate it from the city of Port Harcourt, a 30 kilometres (19 mi) pipeline powers Aba with gas from the Imo River natural gas repository. Its major economic contributions are textiles, pharmaceuticals, plastics, cement, and cosmetics which made the Ariaria international market to become the largest market in West Africa seconded by the onitsha main market. There is also a brewery and distillery within the city. Finally, it is famous for its handicrafts.( www. Wikipedia.org/aba/history/. A free online dictionary).

DATA ANALYSIS (based on the information collected on the field concerning cash-less policy)

This section specifically deals with the analysis of data collected and presented on 4.1 above with other relevant literature. This will enable the researcher accept or reject the hypotheses proposed in the chapter two of this study.

(1) Test of Hypothesis

Hypothesis (H1): There exists a significant relationship between economic growth and adoption of cash-less policy in Nigeria.

To test the hypothesis (H1), the data obtained from table 8 of the data presentation will be used. Therefore, we construct a contingency table to reflect these variables.

S/N |

Options |

(O) observed |

(E) expected |

(O-E) |

(O-E)2 |

|

1 |

Minimize quantity of money a person can carry at a time |

98 |

70 |

28 |

784 |

11.2 |

2 |

Reduce the cost of handling cash |

70 |

70 |

0 |

0 |

0 |

3 |

Reduce cash related crimes |

55 |

70 |

-15 |

225 |

3.2 |

4 |

Reduce inflation |

57 |

70 |

-13 |

169 |

2.4 |

5 |

Discourage money laundering |

70 |

70 |

0 |

0 |

0 |

|

Total |

350 |

|

|

|

X2 = 16.8 |

To get expected frequency (E) = = 70

To get X2 =

At 0.05 level of significance

The critical table value X2 = 9.49

Calculated value X2 =16.8

The critical table value X2 = 9.49

Decision

Since the calculated value X2 = 16.8 is greater than the critical table value X2 = 9.49.

Therefore, we accept the alternative (H1) hypothesis which state that, there exist a significant relationship between economic growth and adoption of cash-less policy in Nigeria.

Also according to the Central Bank of Nigeria, the new cash policy was introduced for a number of key economic reasons, including:

- To drive development and modernization of our payment system in line with Nigeria’s vision 2020 goal of being amongst the top 20 economies by the year 2020, which is a key enabler for economic growth.

- To reduce the cost of banking services (including cost of credit).

- To improve the effectiveness of monetary policy in managing inflation and driving economic growth. Among others (www.cenbank.org/cashless/.).

Dugeri (2013) also noted that the adoption of cash-less policy will go along way in reducing high risk of using cash, inefficiency and corruption among public and private individuals in Nigeria.

(2) Test of hypothesis H1: There exist a significant relationship between relative advantage and adoption of cash-less policy in Nigeria economy?

To test the hypothesis, the data collected in table 6 of the data presentation will be used. Therefore, we construct a contingency table.

Options |

(O) observed |

(E) expected |

(O-E) |

(O-E)2 |

|

Strongly agree |

85 |

70 |

15 |

225 |

3.2 |

Agree |

148 |

70 |

78 |

6084 |

86.9 |

Disagree |

65 |

70 |

-5 |

25 |

0.35 |

Strongly disagree |

30 |

70 |

-40 |

1600 |

22.8 |

Undecided |

22 |

70 |

-48 |

2304 |

32.9 |

Total |

350 |

350 |

|

|

X2 = 146.15 |

To get expected frequency (E) = = 70

where 350 = total number

5 = number of observed frequency

To get X2 =

X2 =

X2 = 146.15 (calculated value)

df = (r – 1) (c – 1)

= (5 – 1) (2 – 1)

= 4

At 0.05 level of significance

The critical table value X2 = 9.49

Calculated value X2 = 146.15

Critical value X2 = 9.49

Decision

Since the calculated value X2 = 146.15 is greater than the critical table value X2 = 9.49.therefore, we accept the alternative H1: hypothesis, which state that, there exists a significant relation between relative advantage and adoption of cash-less policy in Nigeria economy.

In addition to this analysis, Rogers as cited in Odumeru (2013), comment that relative advantage shows the degree to which an innovation is perceived as better than the idea it supersedes. Therefore, the greater the perceived relative advantage of cash-less policy, the more rapid its rate of adoption will be.

More also, Olanipekuni, Brimah and Akanni (2013), observed that the more of Nigerians from cash based transaction to electronic ones is quite alarming as a result of its advantage, they avert that the volume and the value of electronic transactions increased significantly from 195, 525, 568, and N1,072.9 billion in 2010 to 355, 252, 401 and 1,671.4 billion in 2011, reflecting an increase of 81.5 and 55.8 percent respectively (CBN 2011 Annual Report as cited in Olanipelauni et al 2013).

(3) Hypothesis (H1): There exists a significant relationship between compliance and adoption of cash-less policy.

To test the hypotheses (H1) the data obtained from table 5 of the data presentation will be used. Therefore, we construct a contingency table to reflect these variables.

S/N |

Options |

(O) observed |

(E) expected |

(O-E) |

(O-E)2 |

|

1 |

ATMs |

135 |

58 |

77 |

5929 |

102 |

2 |

POS |

40 |

58 |

-18 |

324 |

5.6 |

3 |

Cheque |

120 |

58 |

62 |

3844 |

66.3 |

4 |

E-banking |

42 |

58 |

-16 |

256 |

4.4 |

5 |

All of the above |

7 |

58 |

-51 |

2601 |

44.8 |

6 |

Non of the above |

6 |

58 |

- 52 |

2704 |

46.6 |

|

Total |

350 |

|

|

|

X2 =269.7 |

To get the expected frequency =

To get the

At 0.05 level of significance

The critical table value X2 = 11.07

Calculated value X2 = 269.7

The critical table value X2 = 11.07

Decision

Since the calculated value X2 = 269.7 is greater than the critical table value X2 = 11.07.

Therefore, we accept the alternative (H1) hypothesis which state that, there exists a significant relationship between observability and adoption of cash-less policy in Nigeria.

This test shows that people are complying with this cash-less policy, because having tested and observed it, the adoption level tend to be high.

(4) Test of Hypothesis (H1): There exist a significant relationship between poor infrastructure and policy education and ineffective implementation of cash-less policy in Nigeria.

To test the hypothesis (H1), the data obtained from table 10 of the data presentation will be used.

Therefore, we construct a contingency table to reflect the variables.

SS/N |

Options |

(O) observed |

(E) expected |

(O-E) |

(O-E)2 |

|

1 |

Poor network |

40 |

58 |

-18 |

324 |

5.58 |

2 |

Inadequate infrastructure |

89 |

58 |

31 |

961 |

16.56 |

3 |

Poor sensitization |

78 |

58 |

20 |

400 |

6.89 |

4 |

Cyber theft |

66 |

58 |

8 |

64 |

1.1 |

5 |

Illiteracy |

74 |

58 |

16 |

256 |

4.4 |

6 |

High interest |

3 |

58 |

-55 |

3025 |

52 |

|

Total |

350 |

|

|

|

X2 =86.5 |

To get the expected frequency =

to get chi-square (

At 0.05 level of significant

The critical table value X2 = 11.07

Calculated value X2 = 86.5

The critical table value X2 = 11.07

Decision

Since the calculated value X2 = 86.5 is greater than the critical table value X2 = 11.07.

Therefore, we accept the alternative (H1) hypothesis which state that, there exists a significant relationship between poor infrastructure policy education and ineffective implementation of cash-less policy in Nigeria.

The import of these statements is that inadequate infrastructure, poor policy education are some of the major factors militating against effective implementation of cash-less policy.

Also Odior and Banuso (2012) highlighted some of the challenges of cash-less policy as poor network in Automated Teller Machine (ATM) and point of sales (POS), illiteracy, poverty, inadequate sensitization and many others.

Olanipelauni et al 2013 also confessed that The major challenges faced by users are network problems and service failures, slow transactions, perceived risk, power, long queues, frequent machine breakdown and awareness/literacy. Power, telecommunications, internet and transport infrastructure exert significant impact on service quality. And these according to roggers (2003) may contribute to less adoption of innovation.

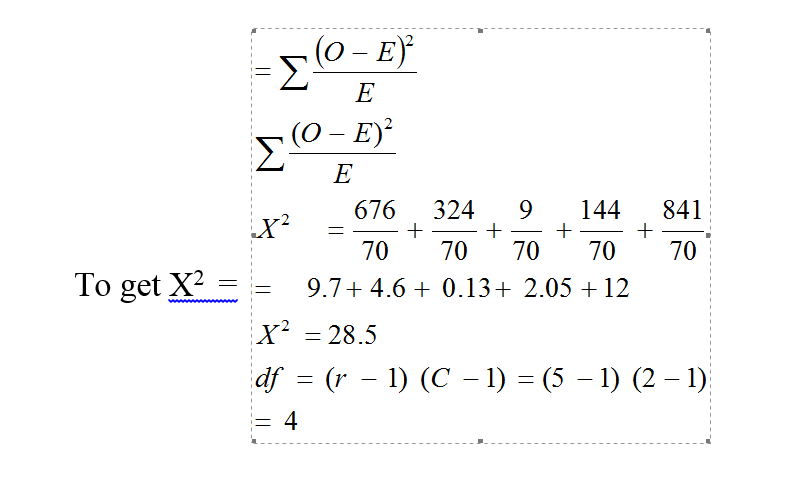

(5) Test of Hypothesis

Hypothesis (H1): There exists a significant relationship between improved policy education, adequate infrastructure and effective implementation of cash-less policy.

To test the hypothesis (H1), the data obtained from table 10.1 of the data presentation will be used. Therefore, we construct a contingency table to reflect these variables.

S/N |

Options |

(O) observed |

(E) expected |

(O-E) |

(O-E |

|

1 |

Improved policy education |

96 |

70 |

26 |

676 |

9.7 |

2 |

Improved infrastructure |

88 |

70 |

18 |

324 |

4.6 |

3 |

Create cyber laws |

67 |

70 |

-3 |

9 |

0.13 |

4 |

Improved power supply |

58 |

70 |

-12 |

144 |

2.05 |

5 |

Removal of high interest rate |

41 |

70 |

-29 |

841 |

12 |

|

Total |

350 |

|

|

|

X2= 28.5 |

To get expected frequency ( ) = = 70

The critical table value at 0.5 level of significance = 9.49

The critical table value = 9.49

The calculated value = 28.5

DECISION

Since the calculated value = 28.5 is greater than the critical table value = 9.49.

Therefore, we accept the alternative (Hi) hypothesis which state that: There exists a significant relationship

between improved policy education, improved infrastructure and effective implementation of cash-less policy.

Moreover, according to the white paper Submitted by: E-PPAN PoS Project Working Group on point of sale (“pos”) terminal as an e-payment channel they noted that

a nationwide aggressive policy education is imperative for effective actualization of cash-less policy. The white paper noted that:

There should be an aggressive nationwide awareness campaign to get people to start using the PoS terminals. People should be enlightened on the benefits of using the PoS and encouraged to use the PoS. This awareness campaign and enlightenment project should be carried out industry wide, especially in regards to fraud prevention. When the systems are relatively reliable and dependable, consumers need to be confident of the security of their money and data and then we will be on the way to wide availability of the PoS. Consumers will demand for the terminals and merchants will be compelled by market forces to acquire them. (E-PPANonhttp://www.eppan.org/eppan_library/White%20Paper%20on%20POS.pdf.)

Also according to online question and answer on the implementation of E-payment in Nigeria by the CBN the following questions and answers were noted. How will the policy achieve the desired goal, given the huge gaps in infrastructure, especially electric power which is critical for efficient e-payment operation? With the following answers: The CBN, in collaboration with the Banks, will continue to educate and sensitise the masses on the advantages/benefits of e-payments as a modern, secure and efficient means of transaction, whilst also putting the infrastructures in place to ensure that e-payment services are within reach and available. Also they noted that the gaps in infrastructure are a huge challenge to economic growth and modernisation in Nigeria. To this end, there are various efforts and initiatives currently in progress to address these gaps, particularly in power supply. (mmabdullahi@cbn.gov.ng).

SUMMARY, RECOMMENDATIONS AND CONCLUSION

SUMMARY

From the research findings, it shows that the adoption of cash-less policy is high because of its policy benefits in Nigeria economy even though it encounters lots of challenges. However, experts and government officials have continued to paint the system in very colorful tones. For instance, the World Bank says that “operating a cashless society in Nigeria was strategy for fast-tracking growth in the nations’ financial sector”.

The findings also show that a variety of benefits are expected to be derived by various stakeholders from an increased utilization of Cash-less policy. This includes;

- For Consumers; increased convenience, more service options, reduced risk of cash-related crimes, cheaper access to (out-of-branch) banking services and access to credit.

- For Corporations; faster access to capital, reduced revenue leakage, and reduced cash handling costs.

- For Government; increased tax collections, greater financial inclusion, reduce corruption, increased economic development.

- For Banks; efficiency through electronic payment processing, reduced cost of operations and increased banking penetration.

- Benefits to the economy ; through the system, users can also pay utility bills, school fees, hotel Bookings, and house rents, among other transactions, using a mobile phone device and money flowing in the same traceable medium.

Indeed, amidst all these benefits exits challenges as the findings show that that the following are impediment for effective implementation of Cash-less policy in Nigeria.

- Infrastructure Deficit: The financial infrastructure in Nigeria is not adequate to carry the load of cash-less society. ATMs, PoS systems and other mediums have to be expanded to touch at least 40% of the whole economy before any meaningful effect can be achieved;

- Power Supply: Erratic power supply has been a major challenge facing every industry in Nigeria. Power supply must be improved drastically to stimulate smooth operations of financial activities;

- Prevalence of e-fraud: High level of fraudulent activities through e-banking is a challenge, which the entire banking industry must resolve before cash-less policy can be effective;

- Literacy level: Literacy rate in the country is very low in some part of the country especially in the North. Business men in this region prefer to keep their money in their private fault rather than patronizing the bank;

- Poor Policy Sensitization: lack of aggressive nationwide campaign and education on the need to adopt cash-less policy medium is a serious challenge. Every new technology into the market has to go through a proper introductory process for the populace to be able to adapt and then benefit from the use of such technology. Most Nigerians do not know what ATM or POS is and are afraid to test it.

- Religious Beliefs: There is presently a psychological war going on in Nigeria over the proposed Islamic banking by CBN, as muslims believe that conventional banks often sin against God by their interest charges. This will greatly affect the achievement of the cashless Nigerian society;

- Lack of Accurate Data: because this policy involves the use of ICT, the Nigerian bankers have kept inaccurate transaction data that can trace transaction error. This creates fear in the minds of the people to adopt the policy.

- High bank charges for the use of e-banking machines: Commission charged by bank on ATM transactions, as an example, are too high, thereby discouraging customers from using it. CBN is working out a modality to stop forthwith charges for usage of ATM. This will be a sort of relief and stimulates the effectiveness of the policy in Nigeria, if fully implemented as promised.

RECOMMENDATIONS

The following recommendations from the research findings will be vital for effective implementation of Cash-less policy in Nigeria.

1. There is the need to intensify the public enlightenment programme about the cash-less system through aggressive media campaign so that everybody will be acquainted with the system and adapt freely. The campaign should involve the religious leaders since the lack of banking culture in especially the Northern part of the country has been largely due to their religious belief and quite often, discussions on policy issues in Nigeria is usually divided between ethnic and religious line (i.e how to make the Fulani herdsmen in Bauchi, the Igbo traders in Aba and the market women in Ijebu-Ode to understand the policy).

2. Since there is a high rate of illiteracy, and all people must be brought into the system, the government through the Central bank of Nigeria should design special enlightenment programmes for non-literates, using probably signs and symbols to educate this segment on how to operate the cashless system.

3. Nigeria government should make concerted efforts to design an internet security framework to check online fraud so that the public can be assured and protected against cyber attack and fraud and also enact some ACTS backing online transaction.

4. There should be a careful study of the system to determine the number of POS terminals and ATMs that will ensure its smooth running in Nigeria so as to prevent unnecessary friction in infrastructure within the system.

5. There should be adequate legislation on all aspects of the operations of the cash-less system so that both the operators of the system and the public can be adequately protected.

6. The CBN, as a pioneer in many innovations, should consider this reward-based system in attracting users to the cashless world, rather than imposing heavy fines on those who have not bought into the policy, many of who are already facing great difficulty in personal affairs, and many of who may eventually become the strongest converts and zealots of the cashless policy if all their needs and fears are suitably addressed.

4.3 CONCLUSION

To sustain an innovation, strategic measures must be taken to reduce negative effects of the problems identified as obstacles to the smooth functioning of the system.

Both the government and CBN have a great role in the introduction, development and maintenance of cash-less banking in Nigerian economy through policies, finance, infrastructure development and massive campaign for the awareness and acceptance of cashless banking among Nigerians.

Above all, Nigerians have a greater role in accepting the cash-less banking payment system, making use of it with the believe that it would improve their financial and economic life and boost the image of the country leading to booming economy. High GDP under the cashless banking system would attract, encourage and build confidence of foreign investors, tourists and analysts, which would on the long run, lead to further development and improvement of our economy.

In summary, the challenge faced by the CBN is not only to strike the right balance but also to ensure the highest standards of consumer protection without eliminating the beneficial effects of responsible innovation on consumer choice and access to credit. Indeed with the necessary instrument put in place Nigeria cannot afford to fail in the Cash-less economy project because is a veritable instrument for actualization of vision 20: 2020.BIBLIOGRAPHY

BOOKS AND JOURNALS

Adewuyi, I. D. (2011) “Electronic Banking in Nigeria: Challenges of the Regulatory Authorities and the Way Forward”. International Journal of Economic Development Research and Investment, April edition, Vol. 2 No. 1; pp149-155.

Ajayi, S. I. and O. O. Ojo (2006), Money and Banking: Analysis and Policy in the Nigerian Context, Second Edition, University of Ibadan, Daily Graphics Nigeria Ltd.

Anderson, J. E. (1997), Public Policy Making (4th ed). New York: Holt, Rinehart and Winston.

Anyanwu, J. C. (1993), Monetary Economics: Theory, Policy and Institutions. Onitsha: Joanee Education Publishing Limited.

Baddeley, M. (2004), “Using E-Cash in the New Economy: An Economic Analysis of Micropayment Systems”, Journal of Electronic Commerce Research, Vol. 5, No.4, pp18-40

Central Bank of Nigeria (2003a). Report of Technical Committee on Electronic Banking. Abuja: CBN.

Charles Worth, J. C. (1967) Contemporary Political Analysis. London: Macmillan Ltd.

Edet, O. (2008), “Electronic Banking in Banking Industries and its Effects”, International Journal of Investment and Finance, Vol.3,No.4 PP 10-16.

Humphrey, D. B. (2004), “Replacement of cash by cards in U.S. Consumer Payments”, Journal of Economics and Business,Vol.14 No. 56, pp 211–225.

Idowu. A. A. (2005). Automated Banking and the Nigerian Economy. Ede: Christatosh Consults.

Odior, E. S and Banuso, F. B. (2012) “Cashless Banking in Nigeria: Challenges, Benefits and Policy Implications”. European Scientific Journal, June edition vol. 8, No.12 pp290-317.

Odumeru, J. A (2013), “Going Cashless: Adoption of Mobile Banking in Nigeria”. Arabian Journal of Business and Management Review (Nigerian Chapter) Vol. 1, No. 2, pp9-17. Retrieved from: http://www.arabianjbmr.com/pdfs/NG_VOL_1_2/2.pdf. on 13th June 2014.Ofuebe, C. and Izueke, E. (2011) Data Demands for Development Research, Enugu: Prince Digital Press.

Oguonu, C. N. and Anugwom, E. E. (2012), Fundamentals of Research in Social Sciences. Enugu: Prince Publications.

Okoli, F. C. (2004), Development administration: Nature and Principles. Enugu: Prince Publications.

Okoye, P.V.C and Ezejiofor, R. (2013), “An Appraisal of Cashless Economy Policy in Development of Nigerian Economy”. Research Journal of Finance and Accounting, Vol.4, No.7, pp237-252.

Olanipekun, W. D., Brimah, A. N. and Akanni, L. F (2013), “Integrating Cashless Economic Policy in Nigeria: Challenges and Prospects”. International Journal of Business and Behavioral Sciences, Vol. 3, No.5; pp12-40 May edition. Retrieved from: http://cprenet.com/uploads/archive/IJBBS_12-1238.pdf on 25th may 2014.

Osuala, E. C. (2007), Introduction to Research Methodology (7th ed) Enugu: Africana First Pub.LTD

Rogers, E M. (1993) Diffusion of Innovations. New York: Free Press.

Sahin, I. (2006), “Detailed Review of Rogers’ Diffusion of Innovations Theory and Educational Technology-Related Studies Based on Rogers’ Theory” The Turkish Online Journal of Educational Technology (TOJET), Vol.5 Art. 3 pp 14-56

Sanusi, L. S. (2011). “Cashless economy in Nigeria”.International Journal of Finance, Vol. 2, No34. pp 18-39.

Siyanbola, T. T (2013), “The Effect of Cashless Banking on Nigerian Economy”. eCanadian Journal of Accounting and Finance, Vol.1,Issue 2.pp.9-19. Retrieved from: http://www.ecanadianjournals.com/journals/vol1Issue2/jaf/THE%20EFFECT%20OF%20CASHLESS%20BANKING%20ON%20NIGERIAN%20ECONOMY.pdf on 2nd march 2014.

Taro, Yamane (1985) Statistics: An introductory Analysis (3rd). New York: Happer and Found Publishers.

Woherem, E .W. (2000) Information Technology in the Nigerian Banking Industry. Ibadan: Spectrum.NEWS PAPERS AND PERIODICALS

Abiodun, E. & Chima, O. (2012). “Cashless Policy: A Burden or Relief?” This day Live. Retrieved from http://www.thisdaylive.com/articles/114483/ on April 25th 2012.

Azeez K, (2011), “Cyber Insecurity Threatens Nigeria Cashless Economy Drive”. Retrieved from : http://www.nationalmirroronline.net/.../22594.htm on 7th may 2014.

BFA (2012) The Journey Toward ‘Cash Lite’: Addressing Poverty, Saving Money and Increasing Transparency by Accelerating the Shift to Electronic Payments, BTCA White Paper written by BFA. Retrieved from: http://betterthancash.org/wpcontent/uploads/2012/09/BetterThanCashAlliance-JourneyTowardCashLite.pdf on28th Jan 2014.

Businessday (2012). “The essence of Cashless Policy.” Retrieved from http://www.businessdayonline.com/NG/index/analysis/editorial/44372/ on 14th September 2012.

CBN, (2011), Further Clarifications on Cash-less Lagos Project. Retrieved from: http://www.cenbank.org/cashless/ on19th Feb. 2014.

CBN: Banking and Payments System Department, (2013). Extention of Cash-less Policy to Five States and FCT. An Internal Memorandom BPS/DIR/GEN/CIR/01/015. At http://www.cbn.gov.ng/

Central Bank of Nigeria (2011), “Money Market Indicators & Money and Credit Statistics”, CBN Statistical Bulletin, CBN Publications. At www.cbn.gov.ng.

Central Bank of Nigeria (2011), Questions and answers on the CBN policy on cash withdrawal/ lodgment limit at http://www.cbn.gov.ng.

Central Bank of Nigeria (2012). “Towards a Cashless Nigeria: Tools and Strategies.” CBN Presentation at the 24th National Conference of Nigeria Computer Society Held at Uyo, Nigeria. From Wednesday 25th Friday 27th July. Retrieved from http://www.NCS.org/presentations/

Dugeri, M. (2013), Cashless Economy in Nigeria: Issues, Challenges and Prospects. Retrieved from http://mikedugeri.wordpress.com/2013/03/21/cashless-economy-in-nigeria/ on 28th Jan. 2014.

Eboh M. (2011), “Cashless Economic Policy will save Nigeria N192bn – CBN”. Retrieved from: http://www.nigerianewsday.com/.../ on 28th April 2012.

EFInA (2012) Access to Financial Services in Nigeria 2012 survey, key findings. available via www.EFInA.org.ng

E-PPAN (2010), White Paper on Point of Sale (“POS”) Terminal as an E-payment Channel. Retrieved from: http://www.e-ppan.org/eppan_library/White%20Paper%20on%20POS.pdf on 13th March 2014.

Ibrahim, K. (2013), “X-raying Cashless policy”. Business and Economy Magazine (March 25): pp38—40.

Oketola, D. (2012, July 30) CBN to Implement Cashless Policy in Stages. Punch. Retrieved from: http://www/punchng.com/business/business.economy/ on July 30 2012.

See “Will Cashless Economy Work? Available at http:// http://www.nigeriafilms.com/news.

Shehu, F. U. (2012), “Issues, Challenges and consumer protection in a cash-less economy. CBN Quarterly publications April – June, vol. 36, No.2 pp3-5.

Shehu, F. U. (2013), “the importance of cashless economy”. The Nations (July 1st ) p6.

Umeano, C. D. (2012), “Cash-less policy in Nigeria: An Overview. CBN Quarterly publications April – June, vol. 36, No.2 pp1-3.